Commercial Auto Insurance Quotes, insure big rig trucks, box trucks, vans, sedans and business fleets

When a business has been classified high risk for one or more reason and has trouble finding commercial auto, commercial truck insurance, general liability or commercial property insurance from readily available companies, we may be able to obtain coverage to help stay insured.

Get quick help and coverage with High Risk Commercial Auto Insurance, business use vehicles, NEMT to Big Rig Commercial Trucks, Box trucks, Taxi, Black Car or Bus fleet coverage.

NJCAIP and alternative coverage business owners help request forms.

Click here if you have all of your information now, otherwise use the quick contact form below.

Business and commercial insurance available now.

We will compare quotes for your commercial insurance options and any available companies that may offer you quotes.

If your company is a new venture you do not necessarily need the high risk commercial auto insurance plan.

What is NJCAIP – NJ Commercial Auto Insurance Plan?

NJCAIP is the state of New Jersey mechanism for eligible Commercially Registered Vehicles in the state of New Jersey that are not insurable immediately in the NJ Voluntary or NJ Preferred Commercial Auto Insurance Markets. Established January 1, 1984 under N.J.S.A. 17:29D-1 and implemented by N.J.A.C. 11:3-1.2, to provide coverage for a commercial automobile risks that are unable to obtain coverage in the NJ business auto insurance voluntary market.

High Risk Commercial or business auto insurance covers a large variety of business types and vehicles from extra heavy tractor trailers to the single vehicle handyman. When getting quotes it will be easier if you have license numbers and vehicle registrations or VIN’S along with prior company loss history(not required for contact) to make quoting easier & accurate.

If you have been refused commercial auto insurance for your business compare rates from the NJ state assigned risk plan known as the New Jersey High Risk Commercial Auto Insurance Plan Quotes.

Many companies require that you have current dated drivers history reports that shows all moving violations and usually list accidents. The report does not usually show what party was at fault in any of the accidents, that is why it is important to have your loss runs or loss history reports for 3-5 years if possible.

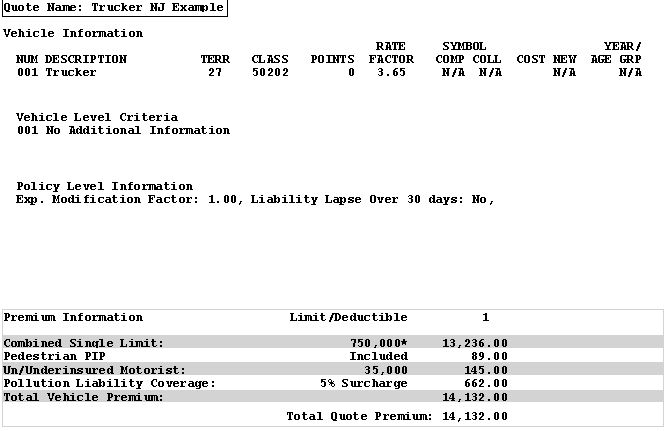

Below is an example and annual cost of NJCAIP – NJ Truck Insurance for one semi truck with federal filings $14,132 for one truck.

Some quotes may be able to bind immediately, while some make take a couple of days. In the worst case scenario the high risk commercial auto policies may have a 17 day waiting period before coverage may become active (refers to state assigned risk plans).

Discuss this and any other questions with your NJCAIP Certified Producer, agent, broker or company to make sure that you do not have any problems.